Succession planning

We support and advise entrepreneurs on a holistic basis and with a wealth of experience as well as expertise in succession planning.

According to various studies and surveys, around 15% of Swiss SMEs are looking for optimal succession planning. Almost every third SME has to cease operations because succession is unsuccessful or impossible. The regulation of own succession is thus one of the greatest challenges a company can face. Good to know that succession planning is one of our absolute core competences.

We will support and advise you as an entrepreneur over the entire process of succession planning. Based on our networked expertise, we can support you as an innovative, forward-thinking and competent general contractor in all entrepreneurial, strategic, business management, tax and legal issues. Your needs and desires, as well as your concerns and fears will of course be taken into account when compiling optimal succession planning, as this is extremely important in each succession plan.

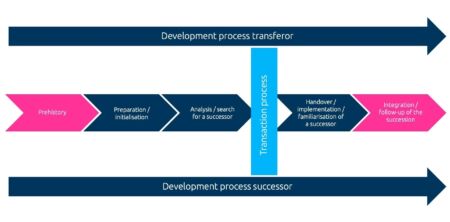

The succession process

For many entrepreneurs, succession planning is a very emotional phase. Each succession process is unique and is more of a marathon than a sprint.

The topics within the various phase sections are different for the transferor and the successor (transferee) and can be shown in simplified form in the graphic below:

Options

Finding the optimal succession solution is key. Many different succession and takeover options are conceivable: Succession within the family (family buy-out), takeover by an external management (management buy-in), takeover by existing employees or the existing management (management buy-out), foundation of a company foundation, sale to a competitor or an investor, etc. Various options also exist for actual transfer (share deal vs. asset deal). The only point that’s open is, which way is the right one. We’ll be happy to support you in finding the optimal solution.

Entrepreneur

As an entrepreneur (seller) of your company, you have put a lot of heart and soul into your company over many years. Now you are about to transfer your life’s work to your successor. In addition to the financial, tax, structural and legal issues, you also need to think about the “life afterwards”.

However, the transferee or successor (buyer), in turn, needs to deal more with other things. How do I become an entrepreneur? Am I able to take over? How can I finance the purchase price? How do I safeguard my family? As a sparring partner and supporter, we can help you to find the right solutions and make the right decisions.

For the transferor and the transferee, the succession process encompasses various different topics, challenges and opportunities. It’s good to know that succession planning is one of our core competences. You will be supported in this process by Balmer-Etienne quickly, competently and individually.

Companies

For a successful transfer, it is key that the company is optimally positioned and well prepared. Every company has its own characteristics. The better the company is placed financially, the higher the corporate value and thus also the selling price. However, many SMEs do not have meaningful numeric data, are not sufficiently digitalised, are highly dependent on the owner or do not have the optimum legal form for the imminent transfer.

We make your company fit for the future, so that on the one hand, a meaningful valuation can be compiled and on the other hand, profitability can also be increased on a targeted and sustainable basis.

Transaction process

A succession or takeover transaction can be very complex in tax, legal and financial terms. It is worth looking at from different angles. In a transaction process, the following documents and records are frequently compiled:

- Company valuation

- Financial planning

- Due-diligence check

- Term sheet

- Purchase agreements, loan agreements, BoD resolutions

- Shareholders’ Agreement

- Tax ruling

- Execution documents

- Marital and inheritance contracts

Don’t worry – in addition to the project manager, Balmer-Etienne has the respective specialists in the company for every specialist subject, who can find quick entrepreneurial solutions. The result? It's very simple: we reduce complexity.